Understanding the Energy Sector

The energy sector is a cornerstone of the global economy, encompassing a wide range of industries involved in the production and distribution of energy. This sector includes traditional energy sources like oil, natural gas, and coal, as well as renewable energy sources such as solar, wind, and hydroelectric power. Understanding the dynamics of the energy sector is crucial for anyone looking to invest in energy stocks. The sector is highly cyclical, often influenced by geopolitical events, technological advancements, and environmental policies. Investors need to be aware of these factors to make informed decisions. Additionally, the energy sector is divided into upstream, midstream, and downstream activities, each with its own set of risks and rewards. Upstream activities involve exploration and production, midstream focuses on transportation and storage, and downstream includes refining and marketing. By understanding these segments, investors can better navigate the complexities of the energy market.

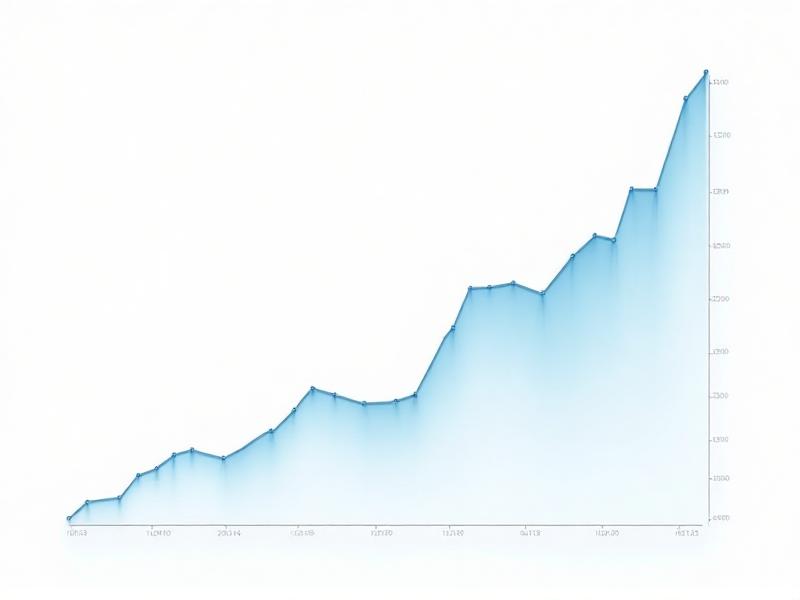

Why Invest in Energy Stocks?

Investing in energy stocks can offer substantial long-term gains, but it requires a strategic approach. Energy is a fundamental need, and as the global population grows, so does the demand for energy. This makes energy stocks a potentially lucrative investment. Moreover, the transition to renewable energy sources presents new opportunities for investors. Companies involved in solar, wind, and other renewable technologies are poised for growth as the world shifts away from fossil fuels. Additionally, energy stocks often provide attractive dividends, making them appealing to income-focused investors. However, it's important to note that the energy sector can be volatile, influenced by factors such as oil price fluctuations, regulatory changes, and technological disruptions. Therefore, investors should carefully consider their risk tolerance and investment horizon before diving into energy stocks. Diversification within the sector can also help mitigate risks, as different types of energy companies may perform differently under various market conditions.

Types of Energy Stocks to Consider

When investing in energy stocks, it's essential to understand the different types available. Traditional energy stocks include companies involved in oil and gas exploration, production, and refining. These companies can be highly profitable but are also subject to significant volatility due to fluctuating oil prices. Midstream companies, which focus on the transportation and storage of energy, often provide more stable returns and are less sensitive to oil price changes. Renewable energy stocks, on the other hand, represent companies involved in the production of clean energy. These stocks are increasingly popular as the world moves towards sustainability. Utility companies, which generate and distribute electricity, are another option. These companies often offer steady dividends and are considered defensive stocks, meaning they tend to perform well even during economic downturns. Finally, there are energy technology companies that develop innovative solutions for energy production and efficiency. These can be high-risk, high-reward investments, as they are often at the forefront of technological advancements. By diversifying across these different types of energy stocks, investors can balance risk and reward in their portfolios.

Analyzing Energy Companies

Analyzing energy companies requires a thorough understanding of both financial metrics and industry-specific factors. Key financial metrics to consider include revenue growth, profit margins, debt levels, and cash flow. Energy companies often have high capital expenditures, so it's important to assess their ability to generate cash and manage debt. Industry-specific factors include reserve levels for oil and gas companies, production costs, and the regulatory environment. For renewable energy companies, factors such as technological advancements, government incentives, and the cost of production are crucial. Additionally, investors should consider the company's management team and their track record in navigating the volatile energy market. Environmental, Social, and Governance (ESG) factors are also becoming increasingly important, as investors are more focused on sustainability and ethical practices. By conducting a comprehensive analysis, investors can identify energy companies with strong growth potential and solid fundamentals, positioning themselves for long-term gains.

Risks and Challenges in Energy Investing

Investing in energy stocks comes with its own set of risks and challenges. One of the primary risks is the volatility of energy prices, particularly oil and gas. Prices can be influenced by a variety of factors, including geopolitical events, supply and demand dynamics, and changes in production levels. Regulatory risks are also significant, as governments around the world implement policies to address climate change and promote renewable energy. These policies can impact the profitability of traditional energy companies while creating opportunities for renewable energy firms. Technological risks are another consideration, as advancements in energy production and storage can disrupt existing business models. Additionally, energy companies often face environmental risks, such as the potential for oil spills or other environmental disasters. Investors should also be aware of the cyclical nature of the energy sector, which can lead to periods of underperformance. By understanding these risks and challenges, investors can better prepare themselves for the uncertainties of energy investing and make more informed decisions.

Strategies for Long-Term Energy Investing

To achieve long-term gains in energy investing, it's important to adopt a strategic approach. One effective strategy is to focus on companies with strong fundamentals and a proven track record of performance. These companies are more likely to weather market volatility and deliver consistent returns over time. Diversification is another key strategy, as it helps spread risk across different types of energy stocks and sectors. Investors should also consider the long-term trends shaping the energy market, such as the transition to renewable energy and the increasing importance of ESG factors. Another strategy is to invest in energy ETFs or mutual funds, which provide exposure to a broad range of energy companies and reduce the risk associated with individual stocks. Additionally, investors should regularly review and adjust their portfolios to align with changing market conditions and their investment goals. By adopting these strategies, investors can position themselves for long-term success in the energy sector and capitalize on the opportunities it presents.

The Role of ESG in Energy Investing

Environmental, Social, and Governance (ESG) factors are playing an increasingly important role in energy investing. Investors are becoming more conscious of the impact their investments have on the environment and society, and they are seeking out companies that prioritize sustainability and ethical practices. In the energy sector, this means a growing focus on renewable energy companies and those that are reducing their carbon footprint. ESG factors can also influence a company's financial performance, as companies with strong ESG practices are often better positioned to manage risks and capitalize on opportunities. For example, companies that invest in clean energy technologies may benefit from government incentives and consumer demand for sustainable products. Additionally, strong governance practices can lead to better decision-making and long-term value creation. As a result, investors are increasingly incorporating ESG considerations into their investment decisions, and energy companies that prioritize ESG are likely to attract more investment and deliver better long-term performance.

Future Trends in the Energy Sector

The energy sector is undergoing significant transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. One of the most notable trends is the shift towards renewable energy, as governments and companies around the world commit to reducing carbon emissions and combating climate change. This shift is creating new opportunities for investors in solar, wind, and other renewable energy technologies. Another trend is the increasing adoption of energy storage solutions, such as batteries, which are essential for managing the intermittent nature of renewable energy sources. The rise of electric vehicles (EVs) is also reshaping the energy landscape, as the demand for electricity to power EVs grows. Additionally, advancements in energy efficiency technologies are helping companies and consumers reduce their energy consumption and costs. These trends are likely to continue shaping the energy sector in the coming years, and investors who stay informed and adapt to these changes will be well-positioned to capitalize on the opportunities they present.